Spanish tax residence – jigsaw puzzles for the initiated!

Looking for a new, friendly (duh! today, one more criterion is relevant!) a safe place for yourself and your loved ones. Spain keeps popping up in the press, in conversations, in plans. Remember. Spain holds numerous advantages making for its attractiveness. However, you will not find taxes among them. As in any project, it is worth taking some time to be thoroughly prepared.

How do you effectively change your tax residence and pay the tax where you want?

Remember, tax residence is like assembling a jigsaw puzzle. It is a whole set of factual elements that make up a whole picture. Or maybe you’d rather play solitaire. You win when all the cards match.

Once you’ve got all the cards in your hand. It is on this “picture” that a complex network of local and international regulations is imposed, which determine where your residence is.

What does it look like in practice? How should you arrange your Spanish tax residence jigsaw puzzle?

More and more often I encounter a situation when you buy an apartment in Spain where you want to stay, live, send children to school or kindergarten, but your business is still in progress in Poland. Some of you hope that they will still pay taxes in Poland and would not like to obtain a Spanish tax residence. Others are willing to obtain a tax residence in Spain but assume that the business will pay taxes in Poland and only in Poland.

Unfortunately, neither approach is correct. Poland will judge you on the basis of the Polish law, Spain will judge you on the basis of the Spanish law and it may turn out that you are actually a tax resident in both countries. This in turn means that both countries may wish to tax the income you have obtained in other countries as well. In other words, you would have to tax the income from the business in Poland in Spain anyway. And you know that taxes reach up to 50% there!

How to avoid double tax residency?

You can make use of double taxation laws that indicate how to resolve a double tax residence conflict. Most often, you just have to move one piece of the puzzle and the situation is again under control. But which one? If you analyse it carefully, you’ll definitely choose the right one. It’s a much worse situation if life itself moves one of the pieces, for example: you cannot find a president to replace yourself and you have to remain in the governing body of your Polish company; the child will go to school in Spain after all or, the opposite, they will not attend it at all. It doesn’t seem to be so bad. But! Your personal life situation is a series of elements that together form your centre of interests in life. Sometimes, only one piece can outweigh the scale and make it tip in favour of the location that you did not consider as your tax residence. And then you have to glance at other elements that you didn’t even have to think about before. And everything needs to be pieced together again.

Any examples? Here you are! This one will be a better illustration of when Spanish tax residence applies and when it does not.

You arrange your life in such a way that your centre of interests – personal and economic ones – will be, for example, in Spain. If the centre of interests is in Spain and you live there, there is a high probability that you will have a Spanish tax residence, or you will pay taxes on your entire annual income there. Later, however, it turns out that something took a different course, and the centre of life’s interests is still in both countries! Then you need to take into consideration the DURATION of your stay. In order to lose your Polish tax residence, you need to stay a certain amount of time in a given country, which you did not plan before, because your business requires you to constantly travel around the world.

Alternatively, you want to maintain a Polish tax residence and you run a business in Poland. But suddenly it turns out that you have too much in common with Spain. So, you have to make sure that you spend enough time in Poland in order not to lose your Polish tax residence.

Another example. You decided to live abroad, but you haven’t chosen a place yet, because you want to take a look around the world and for now you “became installed” temporarily in country C. You were on the right track to lose your tax residence in Poland, but life created a piece of its own scenario again and your plans flopped. It turns out that you still maintain the Polish residence, even though you are practically not here. You have no choice but to re-examine your situation and rearrange the jigsaw puzzles in Country C in such a way as to strengthen your residence there.

These puzzles have their own logic. You have to hold on to it, and it’ll be fine. The most important thing at the beginning is to capture the rules of jigsaw puzzle logic. There appears a problem if you don’t realize the change. So far, you’ve lived in the same country, and you didn’t have to think about it, so you haven’t. When you go abroad, you have to think about it and prepare for the consequences of living and doing business in the international sphere. That’s what this was all about! Is this what you wanted? And when you get to it properly, it turns out the only necessary thing is to learn the rules, and everything will work in your favour.

Okay then! We’ve managed to take control of the situation. So, where do you finally pay your taxes?

If you have decided to remain a tax resident in Poland, and your family lives in a warm climate and you live with them in and out, you must also remember about the tax rules in this new location. Here, let’s return to Spain, which we have come to fancy so much. The fact that you do business in Poland means, of course, that you pay tax in Poland – that’s what you wanted, because no one can topple the Polish lump sum tax or the Polish IPBox (Intellectual Property Rights reliefs). At present we have practically among the lowest taxes in Europe.

Meanwhile, you live in Spain, enjoy the climate, have a beautiful house… You don’t have a Spanish tax residence. However, are you sure you don’t pay tax there?

If you bought a house in Spain, there are two things you need to remember

- First, the wealth tax that, as a non-resident, you have to pay from Spanish property. While the authorities are unlikely to check the contents of your safe or jewellery box, they know a lot about your apartment from official records. This includes the fact that this is your second home, and therefore does not benefit from property tax exemptions for the real properties which are your primary residence.

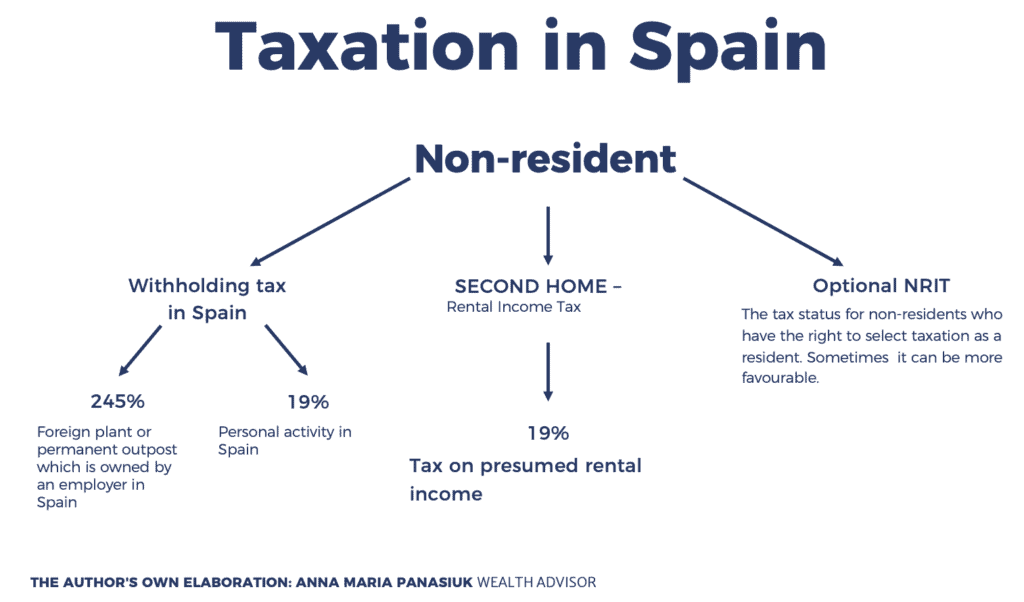

- Since it is a “second home”, it means that you do not live in it all the time, so you should either pay the tax on rental income, or… well, just – the tax on hypothetical rent. In Spain, there is a tax on the so-called assigned income from urban real estate. For non-residents from the European Union, it amounts to 19% of the assigned income. This hypothetical income is an officially imposed calculation of an amount based on the cadastral value of the property and the corresponding ratio (1.1% or 2%). This tax is something different from the property tax. So, when you have a house or apartment in Spain, you should expect that you can pay three different taxes: property tax, real estate tax and income tax.

If you run a business in SPAIN, or, to put it differently, you run it in Poland, but from SPAIN you have to take into account the taxation in Spain. Undertaking economic activity in the territory of that country results in taxation. Of course, it would still be necessary to examine whether the activity carried out in Spain creates a tax establishment there or not. If so, the income obtained through such a permanent establishment should be taxed at a rate of 25% in Spain. However, Spain has introduced internal regulations that allow 19% withholding tax to be taxed on income from economic activity also carried out without a permanent establishment. These provisions give way to an international agreement, so care must be taken to protect yourselves from them.

A FEW WORDS TO REMEMBER

Despite these difficulties, you are still thinking about Spain! Good. It is worth taking care of yourself, children’s education and it is worth investing your money, for example: buying a house. Remember that real estate is the main source of sustenance for the Spanish Treasury. And since you are thinking about Spanish real property, it is worth getting well prepared for the move. And if you’ve already done it, it’s worth checking out that you’ve done it just right.

Blog edited by dr Anna Maria Panasiuk

Founder and Managing Partner of Panasiuk & Partners, with many years of expertise in wealth management.

Authors

dr Maja Czarzasty- Hercberg

OF COUNSEL/ATTORNEY-AT-LAW

Dorota Sajewicz

investment partner

dr Adam Barcikowski

Head of Tax | Certified Tax Advisor

Marta Kwiatkowska - Abramowska

legal assistent

Sylwia Rozwandowicz

ADVOCATE

Sylwia Rybicka

dyrektor ds. rozwoju

Michał Nowacki

radca prawny

Paweł Turek

doradca podatkowy

Katarzyna Zając

aplikant radcowski

Yours Panasiuk

Antoni Goraj

radca prawny

Edyta Winnicka

prawnik

Paweł Szumowski

aplikant radcowski

Yours Panasiuk

Katarzyna Bieńkowska

radca prawny,

doradca podatkowy YOURS Panasiuk

Kamil Kowalik

doradca podatkowy

Monika Baran

radca prawny

Adam Apel

doradca podatkowy

Piotr Świąć

adwokat

Sabina Tyszko

tax consultant

Szczepan Adamski

OF COUNSEL | LAWYER | PRESIDENT OF THE MANAGEMENT BOARD OF YOURS SP. Z O.O.

Magda Kwiatkowska

radca prawny

Andrzej Sałamacha

PARTNER | ATTORNEY-AT-LAW | CERTIFIED INSOLVENCY AND RESTRUCTURING ADVISOR

dr Anna Maria Panasiuk

managing partner | advocate | wealth advisor

Maciej Małachowski

TRAINEE ATTORNEY-AT-LAW

Klaudia Borkowska

Advocate trainee

Archives

-

2024

-

2023

-

2022

-

December

- POLISH FAMILY FOUNDATION – A new solution for entrepreneurs

- POLSKA FUNDACJA RODZINNA – nowe rozwiązanie dla przedsiębiorców

- INVESTMENT FUNDS IN THE NETHERLANDS – ABC OF SETTING UP OF AIF

- FUNDUSZE INWESTYCYJNE W HOLANDII – ABC ZAŁOŻENIA AFI

- TAX INCENTIVES TO INVEST IN AN ALTERNATIVE INVESTMENT FUND (AIF)

- ZACHĘTY PODATKOWE DO INWESTYCJI W ALTERNATYWNĄ SPÓŁKĘ INWESTYCJNĄ (ASI)

-

November

-

October

- CAN AN ALTERNATIVE INVESTMENT FUND SERVE THE PURPOSES OF PRIVATE INVESTMENTS?

- CZY ALTERNATYWNA SPÓŁKA INWESTYCYJNA MOŻE SŁUŻYĆ PRYWATNYM INWESTYCJOM?

- M&A – TRANSACTION TRIVIA IN MERGERS & ACQUISITIONS

- M&A – CIEKAWOSTKI TRANSAKCJI MERGERS & ACQUISITION

- HISZPAŃSKA REZYDENCJA PODATKOWA – PUZZLE DLA WTAJEMNICZONYCH!

- Spanish tax residence – jigsaw puzzles for the initiated!

-

September

-

August

-

July

-

May

- PODWÓJNA REZYDENCJA PODATKOWA – 4 PRZYKŁADY POWSTANIA [CZĘŚĆ II OSOBY PRYWATNE]

- DUAL TAX RESIDENCE – 4 EXAMPLES OF ITS EMERGENCE [PART II NATURAL PERSONS]

- INVESTORS’ Q&A ABOUT THE ALTERNATIVE INVESTMENT FUNDS

- O CO NAJCZĘŚCIEJ PYTAJĄ INWESTORZY W KONTEKŚCIE ASI (ALTERNATYWNYCH SPÓŁEK INWESTYCYJNYCH)?

- REVOLUTION ON THE MERGERS & ACQUISITIONS MARKET – RECORD-BREAKING M&A TRANSACTIONS IN POLAND

- REWOLUCJA NA RYNKU FUZJI I PRZEJĘĆ – REKORDOWE TRANSAKCJE M&A W POLSCE

- 7 SINS COMMITTED WHILE RUNNING A BUSINESS AND MAKING INVESTMENTS

- 7 GRZECHÓW PRZY PROWADZENIU BIZNESU I INWESTYCJACH

-

April

-

March

-

February

- SIMPLE CONSERVATIVE INVESTMENTS. HISTORICAL ANALYSIS OF THE LAST 20 YEARS

- PROSTE INWESTYCJE KONSERWATYWNE. ANALIZA HISTORYCZNA OSTATNICH 20 LAT

- CZY WARTO ZAMIESZKAĆ W HISZPANII? PRAWO BECKHAMA, CZYLI JAK NIE PŁACIĆ PODATKÓW W HISZPANII

- IS IT WORTH LIVING IN SPAIN? BECKHAM ‘S LAW, HOW TO AVOID PAYING TAXES IN SPAIN

- ESTONIAN CIT 2022 AS A REMEDY FOR THE POLISH DEAL

- ESTOŃSKI CIT 2022 JAKO REMEDIUM NA POLSKI ŁAD

-

January

- HOW CAN YOU SET UP AN ALTERNATIVE INVESTMENT FUND IN A FEW WEEKS?

- JAK MOŻNA ZAŁOŻYĆ ALTERNATYWNĄ SPÓŁKĘ INWESTYCYJNĄ W KILKA TYGODNI?

- DO CLOSED-END INVESTMENT FUNDS STILL PAY OFF?

- CZY FUNDUSZE INWESTYCYJNE ZAMKNIĘTE JESZCZE SIĘ OPŁACAJĄ?

- 6 REASONS WHY IT IS WORTH DEVELOPING A BUSINESS OUTSIDE POLISH BORDERS

- 6 POWODÓW, DLA KTÓRYCH WARTO ROZWIJAĆ BIZNES POZA POLSKĄ

-

December

-

2021

-

December

-

November

-

October

- LIFE IN TENERIFE – TAXES AND REAL ESTATE IN THE CANARY ISLANDS

- TENERYFA NA ŻYCIE – PODATKI I NIERUCHOMOŚCI NA WYSPACH KANARYJSKICH

- TURNKEY REORGANISATION – HOW TO PREPARE A BUSINESS FOR INTERNATIONAL EXPANSION

- REORGANIZACJA POD KLUCZ CZYLI JAK PRZYGOTOWAĆ BIZNES NA EKSPANSJĘ ZAGRANICZNĄ

- BUSINESS EXPANSION OUTSIDE THE EU – LET’S HAVE A LOOK AT OTHER CONTINENTS

- EKSPANSJA BIZNESU POZA UE – SPÓJRZMY NA INNE KONTYNENTY

-

September

-

August

- MAJĄTEK RODZINNY

- COMPANY RELOCATION WITHIN THE EU: PROCESS ANALYSIS AND CASE STUDY

- PRZENIESIENIE SPÓŁKI W OBRĘBIE UE: ANALIZA PROCESU I CASE STUDY

- SCALING UP BUSINESS. TAXES IN ESTONIA, ITALY, UNITED KINGDOM, MALTA AND CYPRUS – COMPARISON

- EKSPANSJA BIZNESU. PODATKI W EUROPIE.

- POLSKI ŁAD OCZAMI PRZEDSIĘBIORCY

-

July

- EXPANDING NEXT DOOR – THE CZECH REPUBLIC, SLOVAKIA, GERMANY, ROMANIA

- EKSPANSJA PO SĄSIEDZKU – CZECHY, SŁOWACJA, NIEMIECY, RUMUNIA

- CONVERTIBLE DEBT IN POLAND

- CONVERTIBLE DEBT PRZY INWESTYCJACH PRE-SEED

- AIFs (ALTERNATIVE INVESTMENT FUNDS) LEAD THE WAY ON THE POLISH CAPITAL MARKET

- ASI WIEDZIE PRYM NA POLSKIM RYNKU KAPITAŁOWYM

- FAMILY FOUNDATIONS IN POLAND. CONCEPT VERSUS ENTREPRENEURS’ EXPECTATIONS

- FUNDACJA RODZINNA W POLSCE. ISTOTA POMYSŁU A OCZEKIWANIA PRZEDSIĘBIORCÓW

-

June

- CORPORATE TAX RELIEF AND INCENTIVES FOR INVESTORS – NEW (BETTER?) SOLUTIONS

- ULGI PODATKOWE I ZACHĘTY DLA INWESTORÓW – IDZIE NOWE (LEPSZE?)

- 9% CIT ZAMIAST 19%, JAK PŁACIĆ NIŻSZY PODATEK

- CYPRUS VS. UNITED ARAB EMIRATES, WHERE TO MOVE? CHANGE OF TAX RESIDENCE

- CYPR VS. ZJEDNOCZONE EMIRATY ARABSKIE, GDZIE SIĘ WYPROWADZIĆ? ZMIANA REZYDENCJI PODATKOWEJ

-

May

-

April

-

March

-

February

-

January

- 6 MAJOR CHANGES IN THE BEHAVIOUR OF PRIVATE INVESTORS AND THEIR PORTFOLIOS IN 2020

- 6 GŁÓWNYCH ZMIAN W ZACHOWANIACH I PORTFELACH INWESTORÓW PRYWATNYCH W ROKU 2020

- TAX SIMPLIFICATION 2021 IN POLAND – A MAGNET FOR FOREIGN INVESTORS

- UPROSZCZENIA PODATKOWE 2021 W POLSCE – MAGNESEM DLA INWESTORÓW ZAGRANICZNYCH

- ALTERNATIVE INVESTMENT FUND (AIF) – A FIRST-CLASS INVESTMENT VEHICLE AT YOUR FINGERTIPS

- ALTERNATYWNA SPÓŁKA INWESTYCYJNA (ASI). PIERWSZORZĘDNY WEHIKUŁ INWESTYCYJNY NA WYCIĄGNIĘCIE RĘKI

- ESTONIAN CIT – EFFECTIVE REDUCTION IN CORPORATE TAX IN POLAND

- CIT ESTOŃSKI – EFEKTYWNE OBNIŻENIE OPODATKOWANIA SPÓŁEK W POLSCE

-

December

-

2020

-

December

-

November

- WE BREAK STEREOTYPES! PRECONCEPTIONS ABOUT LAWYERS AND THE REALITY OF BUSINESS

- AM I REALLY SAVING MYSELF MONEY? TODAY I WILL SAVE 100 PLN TO LOSE 1000 PLN TOMORROW

- ŁAMIEMY STEREOTYPY! CZYLI PRZEKONANIA O PRAWNIKACH, A REALIA BIZNESU

- CZY TO NAPRAWDĘ OSZCZĘDNOŚĆ? DZIŚ „ZAOSZCZĘDZĘ” 100 ZŁ ŻEBY JUTRO STRACIĆ 1000 ZŁ

- ZAPRASZAMY do MONAKO

- WHY IS IT WORTH BECOMING A TAX RESIDENT OF MONACO?

- DLACZEGO WARTO ZOSTAĆ REZYDENTEM MONAKO? PODATKI W MONAKO

-

October

-

September

-

August

-

June

- THE WORLD IS CHANGING, AND YOU ARE STILL LOOKING FOR A UNICORN? In this article, we tell you everything you need to know to find one

- ŚWIAT SIĘ ZMIENIA, A TY WCIĄŻ SZUKASZ JEDNOROŻCA. Wszystko co musisz wiedzieć aby go znaleźć napisaliśmy tutaj

- KRYZYSOWE INWESTYCJE, CZYLI: ODWAŻNA INWESTYCJA WYMAGA OSTROŻNEGO PLANOWANIA

- JAK TRWOGA TO DO PRAWNIKA – NIEPOKOJĄCE TENDENCJE WŚRÓD STARTUPÓW

-

May

-

April

- AMERICAN TAX COMPETITION. HELPFUL OR “HARMFUL”

- KONKURENCJA PODATKOWA PO AMERYKAŃSKU. POŻĄDANA, CZY „SZKODLIWA”

- PIENIĄDZE TO NIE WSZYSTKO. Czyli jak inwestować, żeby nie stracić

- INVESTING IN HARD TIMES: HOW TO SET UP YOUR BUSINESS IN NEW YORK

- APETYT NA INWESTYCJE W TRUDNYCH CZASACH. SPÓŁKA W NOWYM YORKU

- WPŁYW PANDEMII NA TRANSAKCJE FUZJI I PRZEJĘĆ

- IMPACT OF A PANDEMIC ON MERGERS AND ACQUISITIONS

- PODATKI NA TRUDNE CZASY

-

March

-

February

-

December

-

2019

-

2018

-

2017

-

2016

-

2015

-

December

-

November

- Zwrot PCC od czynności restrukturyzacyjnych z udziałem spółek komandytowo-akcyjnych

- Zmiany podatkowe na Cyprze zachętą dla potencjalnych inwestorów

- Cypryjskie fundusze inwestycyjne mogą korzystać ze zwolnienia podatkowego w Polsce

- Nowe sankcje za niezłożenie sprawozdania finansowego

- Europejskie poświadczenie dziedziczenia

-

October

-

July

-

December

Categories

- Alternative Investment Fund (15)

- Expansion (12)

- Investments (34)

- Jurisdictions (11)

- Law (13)

- M&A (11)

- POLISH FAMILY FOUNDATION (2)

- Polish Holding Company (2)

- Relocation (9)

- Reorganisation (6)

- Succession (9)

- Tax (28)

- Tax accounting (2)

- Tax Preferences (2)

- Tax Residence (10)

- Wealth Advisory (9)

New publications

You want to be up to date, enter your e-mail address and you will receive new publications straight to your inbox: